A brand new revenue tax survey performed by ACI Worldwide, in collaboration with YouGov, has revealed that just about 40% of US taxpayers plan to make use of their tax refunds to repay debt, corresponding to bank cards and loans.

The findings counsel that the continuing inflationary pressures are persevering with to erode disposable revenue, with many People leaning on their tax refunds to handle monetary obligations.

Along with this pattern, 44% of respondents indicated they’d deposit their tax refunds right into a financial savings account, reflecting a rising sense of monetary warning and a shift away from instant discretionary spending.

The outcomes level to declining financial optimism as people prioritise debt discount and monetary safety over consumption.

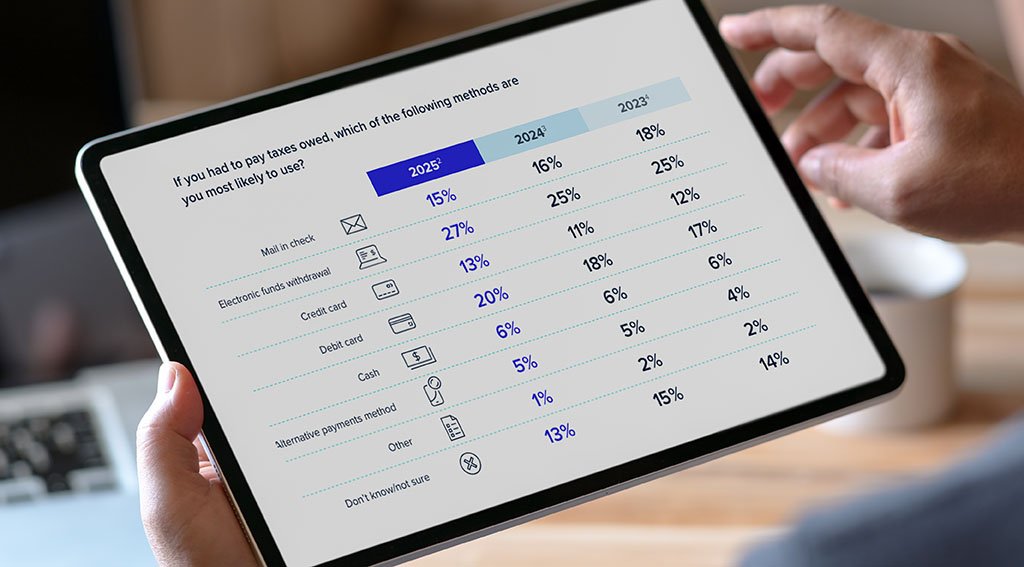

The survey additionally highlights a continued rise within the adoption of digital fee strategies throughout tax season. Sixty-five per cent of respondents reported a desire for paying taxes digitally, whereas the usage of paper-based cheques declined year-over-year to simply 15%.

This lower is essentially attributed to Child Boomers and Technology X, as youthful generations more and more favour different fee options corresponding to PayPal, Google Pay and Apple Pay.

The shift towards digital comfort was additionally obvious in how respondents wished to obtain their tax refunds, with 80% preferring digital deposit over conventional strategies.

“As we enter the tax season, many People need to maximise their tax refunds and make good monetary selections, whether or not it’s paying off high-interest debt or increase their financial savings,”

mentioned Ron Shultz, Basic Supervisor of ACI Speedpay.

“This yr’s findings present that taxpayers are persevering with to pivot to digital fee channels to pay taxes and obtain their refunds shortly. ACI’s digital fee options empower People to satisfy their tax obligations in a quick and safe method and take management of their funds.”

The survey additionally uncovered decrease ranges of consciousness round widespread fee fraud schemes, notably amongst Technology Z respondents.

This underscores the necessity for continued shopper training as an important line of defence in opposition to tax-related scams.

Amongst those that reported encountering scams, roughly one-third had been focused by fraudsters impersonating the Inner Income Service (IRS) by way of cellphone or e-mail.

The info additionally revealed a 3% enhance in id theft instances, the place private info is used fraudulently.

“Tax season is a chief alternative for scammers to focus on customers who really feel overwhelmed by the complexities and time pressures of submitting,”

added Shultz.

“By utilizing safe digital fee channels with strong verification capabilities, taxpayers can safeguard their monetary info and make sure that their refunds and funds are dealt with safely and effectively.”

The survey additionally explored tax submitting preferences, revealing that 39% of respondents plan to file electronically utilizing well-liked software program platforms corresponding to TurboTax, H&R Block and TaxSlayer.

One other 27% will file electronically or by submit with the help of a tax skilled, whereas 11% nonetheless desire to file by way of paper mail.

When requested how they’d allocate their tax refunds, the highest three responses had been: 44% would deposit the funds right into a financial savings account, 39% would apply the cash towards excellent money owed, and 20% would use it for minor purchases, corresponding to clothes or sporting items.

Lastly, the commonest fraud experiences reported by respondents included cellphone scams (17%), phishing scams (16%), and id theft (13%), even when the fraudulent makes an attempt had been finally unsuccessful.

Featured picture credit score: edited from freepik