The Digital Euro CBDC marks a daring transfer by the European Central Financial institution to replace Europe’s cash system. This Central Financial institution Digital Foreign money challenge will minimize ties with international cost corporations and enhance Europe’s management over its cash. Latest adjustments in CBDC Europe present that the ECB desires to roll out a digital euro to repair issues with funds, charges, and cash being despatched overseas.

How the Digital Euro CBDC Goals to Revolutionize European Funds

Constructing the Digital Euro CBDC Basis

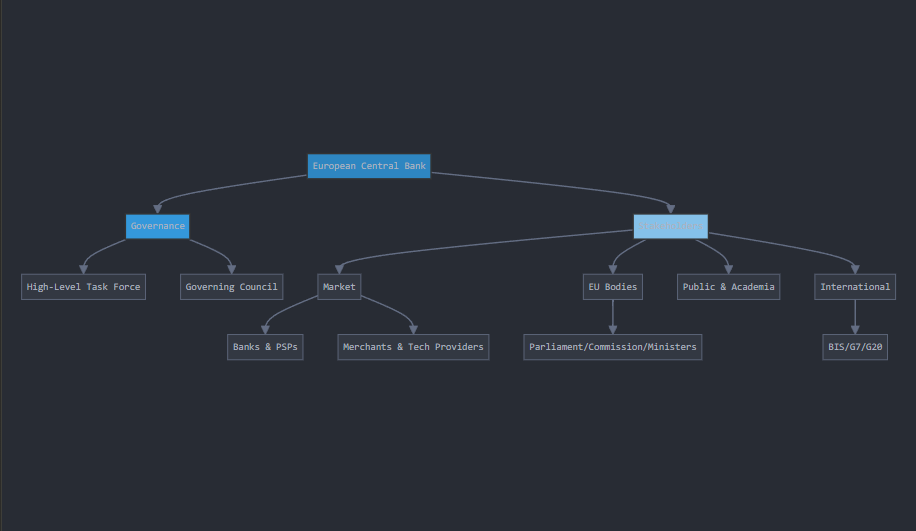

The ECB created a Digital Euro Rulebook for his or her challenge. They arrange seven work groups to deal with person options and security measures. The European Central Financial institution works with shops, tech companies, and cost corporations to check automated funds. Outcomes will come out by July 2025. These groups assist unfold digital euro adoption throughout Europe.

Privateness and Management: A Crucial Turning Level

The Digital Euro CBDC faces pushback from privateness teams. Crypto analyst Kim Dotcom‘s warning on X about monetary surveillance and management has sparked intense debate:

“By no means use the digital Euro. It’s a monetary surveillance and management software. First the digital Euro then digital ID and social scores. If you happen to do or say something they don’t like your funds can be blocked. Be good. Be your individual financial institution.”

This warning reveals rising fears about authorities management and freedom in digital cash, making clear that CBDC in Europe have to be open about its plans.

Influence on European Monetary Sovereignty

The Central Financial institution Digital Foreign money goals to cut back the facility held by Visa and Mastercard. This transfer would possibly problem the US greenback’s energy in world commerce. The adoption of the digital euro will make sending cash quicker, cheaper, and clearer, probably altering how world finance works.

Implementation Timeline and Public Belief

The European Central Financial institution began searching for corporations to construct digital euro components, with solutions due in 2025. They’re determining limits on holdings and guidelines. They examine what folks wish to be sure the foreign money works nicely and stays steady. Success depends upon mixing new tech with privateness safety.

World Monetary Transformation

The Digital Euro CBDC may change world banking by giving new methods to pay. Corporations and folks will get higher cost decisions and possibly decrease charges. However privateness considerations present we want sturdy protections to stop misuse and hold public belief in future digital cash.

Hyperlink: https://watcher.guru/information/european-central-banks-digital-euro-cbdc-will-it-transform-europe?utm_source=pocket_shared

Supply: https://watcher.guru