Scams

The web could be a great place. Nevertheless it’s additionally awash with fraudsters preying on people who find themselves vulnerable to fraud.

06 Mar 2024

•

,

5 min. learn

We’re all getting older. That’s excellent news for digital fraudsters, who see wealthy pickings available in a quickly ageing society. They’re more and more focusing on senior residents as a result of they believe these targets to have extra money to steal, however probably much less digital savvy to identify the early warning indicators of a rip-off. In 2022, $3.1 billion in cybercrime losses had been reported to the FBI by the over-60s, on the again of 88,262 incidents. Though that represented an 82% year-on-year enhance, many extra circumstances won’t have been reported.

The influence of such scams may be devastating when you’ve already retired and don’t have any supply of earnings to switch financial savings misplaced to fraudsters. So when you’re a senior citizen, or a involved relative, learn on.

10 scams to be careful for

The web can, after all, be a beautiful place. Nevertheless it’s additionally awash with dangerous individuals making an attempt to steal your private data and cash. Listed here are a few of the commonest schemes:

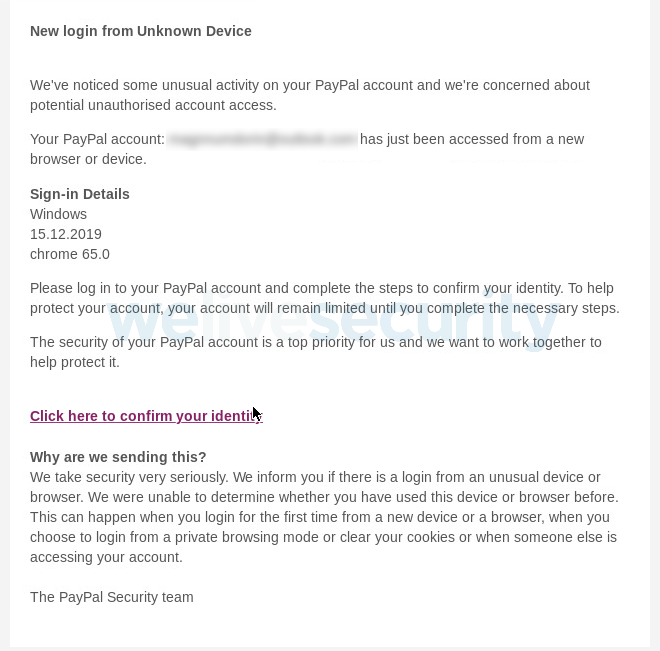

1. Phishing

Let’s begin with a risk that may be a scourge of the trendy web: phishing. A phishing electronic mail or cellphone/social media message will arrive unsolicited. The scammer impersonates a respectable entity requesting you provide data reminiscent of account log-ins, or click on on a hyperlink/open an attachment. The previous might allow them to hijack your accounts, whereas the latter could set off a malware obtain designed to steal extra information or lock down your pc.

2. Romance scams

Romance scams made $734 billion for fraudsters in 2022, the FBI says. Scammers will create pretend profiles on courting websites, befriend lonely hearts and construct a rapport, with the goal of extracting as a lot cash as attainable. Typical tales are that they want cash for medical payments or to journey to see their sweetheart. For sure they are going to all the time discover an excuse to not seem on a video name or meet in particular person.

3. Medicare/healthcare

The scammer impersonates a Medicare consultant with the goal of eliciting private and medical data that may be bought on to others to commit medical insurance fraud. They could do that on electronic mail, by cellphone and even in particular person.

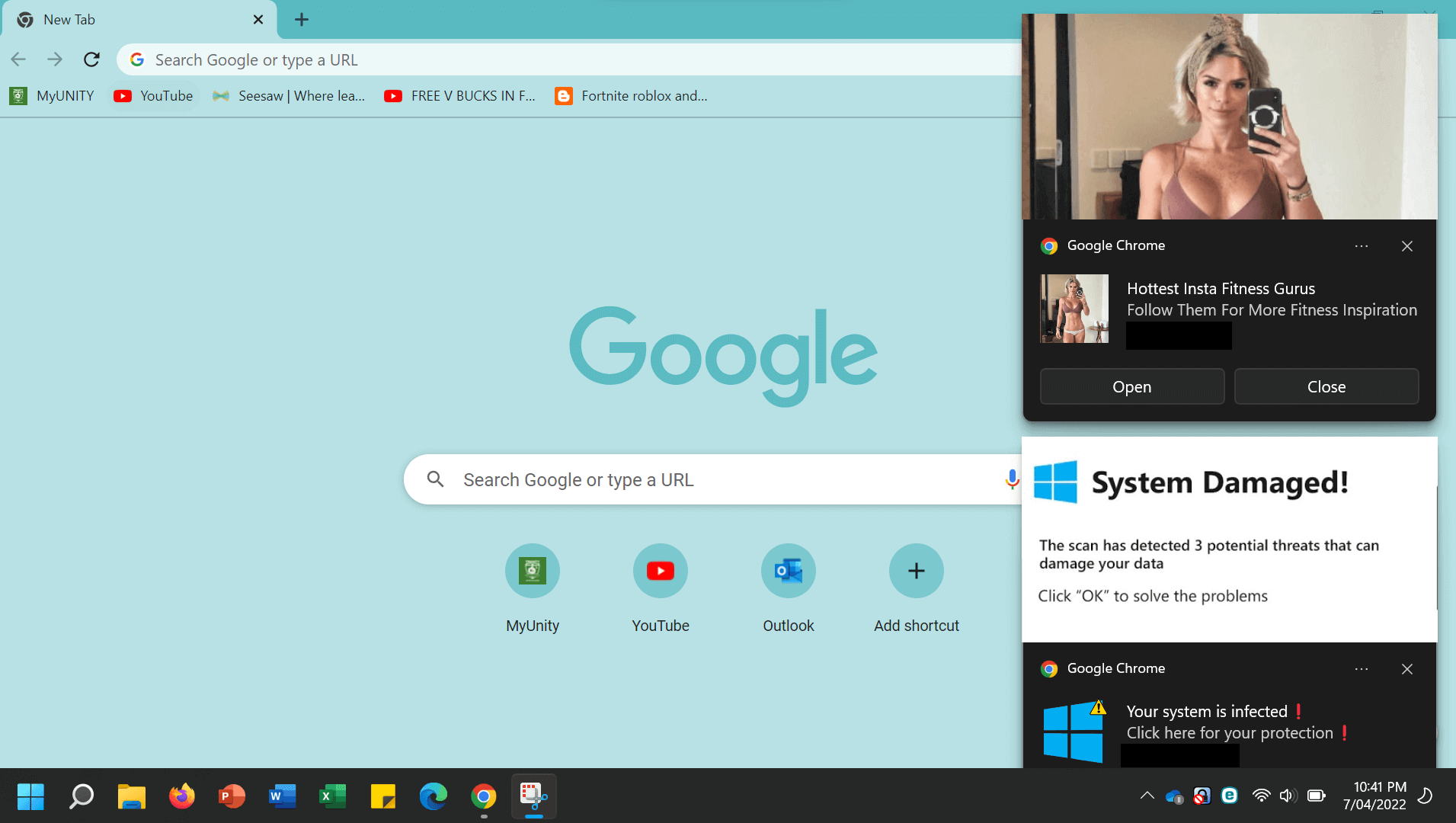

4. Tech assist

In one of many oldest phone-based scams, the fraudster impersonates a respectable entity like a tech firm or telco supplier, telling you there’s one thing fallacious together with your PC. This may occur out of the blue, otherwise you may be prompted to name a ‘helpline’ after a innocent however worrying pop-up seems in your pc. The scammer could trick you into offering them entry to the machine. They’ll attempt to discover a manner of creating wealth out of you; for pointless ‘safety’ or ‘upgrades’ of the machine, or by stealing monetary data from it.

5. On-line buying fraud

Scammers create legitimate-looking on-line shops after which appeal to customers to go to them through phishing emails or unsolicited texts or social media messages. Gadgets are sometimes marked down with unbelievable gives. Nevertheless, merchandise are both counterfeit, stolen or non-existent and the true aim is to steal your card particulars.

6. Robocalls

Robocalls depend on automated expertise to nuisance name massive numbers of recipients directly. A pre-recorded message could also be used to supply free or closely discounted items. Or it may very well be used to scare the recipient into responding, reminiscent of telling them they’re the topic of an impending lawsuit. If you happen to reply, the scammers will attempt to get hold of your private and monetary data.

7. Authorities impersonation

Like tech assist scams, these are normally carried out by name facilities based mostly in south Asia. Mixed losses topped $1 billion in 2022. On this model, the scammer will name pretending to be from the IRS, Medicare or different authorities physique demanding unpaid taxes or different funds. They are going to aggressively warn that non-payment might result in arrest or different penalties.

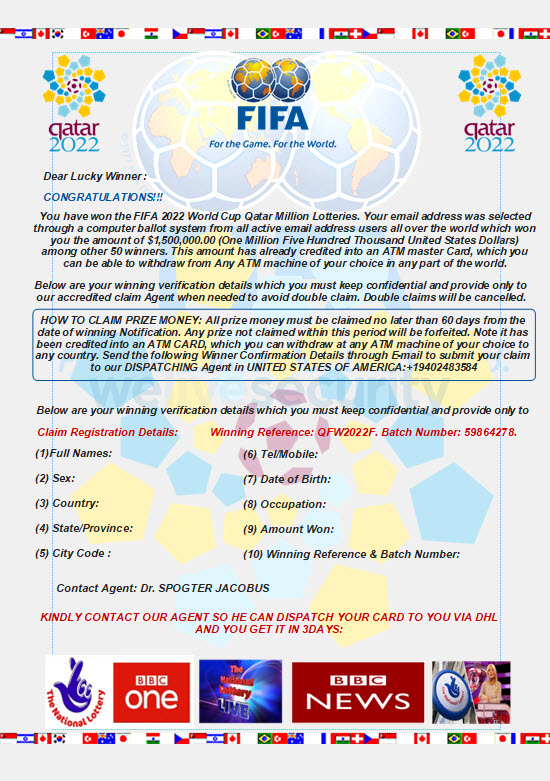

8. Lottery scams

A fraudster calls out of the blue claiming you’ve gained a lottery and all you should do to reclaim your winnings is ship a small processing price or tax up entrance. After all, there isn’t a prize and your cash will disappear.

9. Grandparent rip-off

A scammer calls you up unannounced pretending to be a relative in jeopardy. They’ll usually begin by saying one thing like “Hello Grandma, are you aware who that is?” after which proceed with a story of woe designed to steer you into parting with money to assist them. Normally they’ll request a cash switch, present playing cards or cost through a money app. They could ask that you simply preserve all the pieces a secret. In some variations on this theme, the scammer pretends to be an arresting police officer, physician or lawyer making an attempt to assist the grandchild. Advances in AI software program often called deepfakes could even allow them to imitate the voice of your grandchild extra precisely to perpetrate what has come to be known as “digital kidnapping scams”.

10. Funding scams

The very best earner for cybercriminals in 2022, making over $3.3 billion, this class refers to get-rich-quick schemes that promise low threat and assured returns, usually via cryptocurrency investments. In actuality, the entire scheme is constructed on sand.

How one can keep protected

We’ve written about this earlier than and though the scammers’ ways could change, greatest apply recommendation stays fairly constant. Keep in mind the next to remain protected:

- If a proposal is simply too good to be true it normally is.

- Deal with any unsolicited contact with suspicion. If you wish to reply, by no means reply on to a message. As a substitute, Google the sending establishment and name or electronic mail individually to verify.

- Keep calm, even when harangued on the cellphone. And don’t give out any private data.

- Don’t belief Caller ID as it may be faked.

- Use multi-factor authentication in your accounts to mitigate the specter of somebody stealing your logins.

- By no means ship cash through wire switch, cost apps, present playing cards or cryptocurrency, as there’s no manner of requesting it again within the introduction of fraud.

- Don’t click on on hyperlinks or open attachments in emails/texts/social media messages.

What to do when you’ve been scammed

If you happen to suppose you may need been scammed, get in contact with native police, your native financial institution (if monetary particulars had been concerned) and even (within the US) Adult Protective Services. Additionally it is a good suggestion to reset your passwords when you’ve handed them over to a possible scammer. Within the US, take into account reporting the case to the FTC.

If you happen to learn this and have aged kin you’re involved about, take the time to have a chat about frequent scams. Know-how can usually be intimidating if we don’t absolutely perceive it. Nevertheless it’s that reluctance to seek out out extra – and our reluctance to inform anybody about being scammed – that fraudsters reap the benefits of. Let’s not allow them to have the final snicker.